VOLUNTARY RECALL FOR ALL-TERRAIN Ridge JOGGING STROLLERS MANUFACTURED BETWEEN JULY 2021 AND AUGUST 2022.

Our top priority at UPPAbaby is the safety of children. We conduct extensive testing to ensure UPPAbaby products meet all global industry and regulatory standards. Despite passing all tests and meeting all standards, UPPAbaby received one report about the all-terrain Ridge stroller.

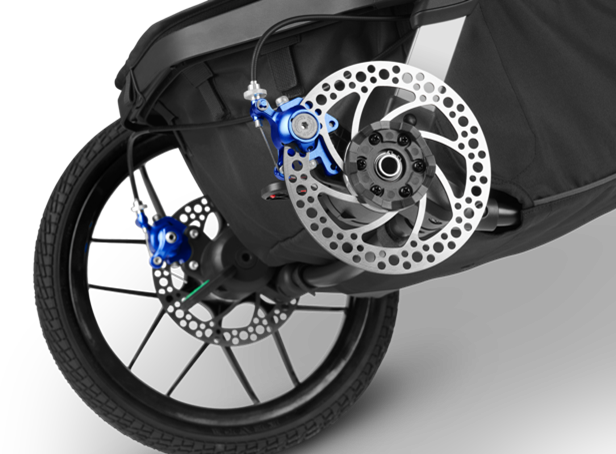

We take all product inquiries very seriously. Based on one consumer report to us, we believe the injury is likely due to consumer misuse. The Ridge’s disc brakes have openings that can cause amputation or laceration if a non-occupant child’s fingertip gets caught in the openings while the stroller is in use.

Recall Summary

NAME OF PRODUCT: UPPAbaby All-Terrain Ridge Jogging Strollers

HAZARD: The stroller’s rear disc brakes have openings that can cause amputation or laceration if a non-occupant child’s fingertip gets caught in the openings while the stroller is in use.

REMEDY: Repair

Consumers who own an UPPAbaby All-Terrain Ridge Jogging Stroller manufactured between July 2021 and August 2022 will receive free replacement disc brakes for both wheels to be added to their existing all-terrain Ridge jogging stroller.

Consumers should go here to confirm their all-terrain Ridge jogging stroller is included in the recall.

CONSUMER CONTACT: UPPAbaby toll-free at 844-823-3132 from 9 a.m. to 5 p.m. ET Monday through Friday, email support@uppababy.com or online at www.uppababy.com/ridge/disc-brakes/ and click on “Submit Info” at the bottom of the page or go to www.uppababy.com and click on “Click to read more” next to the recall announcement.

Recall Details

UNITS: About 14,400

DESCRIPTION: This recall involves all UPPAbaby all-terrain Ridge jogging strollers, which have an extendable canopy with a mesh window and zipper pocket, disc hand brake system and an adjustable handlebar with a wrist strap. The brand (UPPAbaby) is on the front of the stroller, and Ridge is on the side of the stroller frame. The strollers have a black frame and a fabric color scheme that is white (“BRYCE”), charcoal (“JAKE”), or slate blue (“REGGIE”) and have black tires. The serial numbers of the recalled products begin with “1401RDGUS” and appear on the right side of the stroller frame above the rear wheel of the stroller. The model number “1401-RDG-US” is printed on the left side of the stroller frame above the rear wheel of the stroller.

INCIDENTS/INJURIES: The firm has received one reported incident, resulting in a fingertip amputation to a child who was not in the stroller while in use.

SOLD AT: BuyBuyBaby, Nordstrom, Neiman Marcus, Pottery Barn Kids and other children’s stores and specialty stores nationwide and online at Amazon from July 2021 through August 2022 for about $600.

IMPORTER: Monahan Products, LLC, d/b/a UPPAbaby, of Rockland, Mass.

MANUFACTURED IN: China