Premium finishes to build.

Choose your frame

Premium finishes to build your stroller foundation.

Customize the perfect Vista V2 or Cruz V2 stroller for your family at our Boston Hub Service Center! Choose your frame, add your favorite combination of fabric and leather, and personalize it for a special touch. With our Tailored Customization Studio, you can design your very own ride, tailored to your family’s needs. Go ahead, put your creative cap on and be the designer of your one-of-a-kind stroller!

Premium finishes to build.

Premium finishes to build your stroller foundation.

Raise the bar with elevated accents.

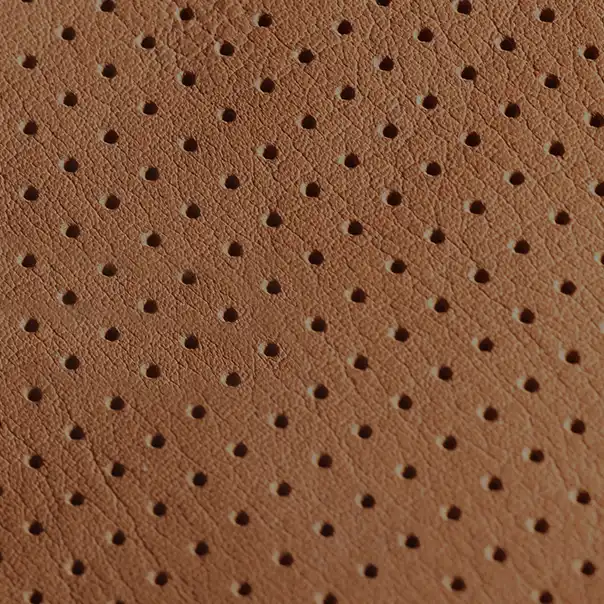

100% full-grain, REACH certified leather. Offered in an assortment of colors.

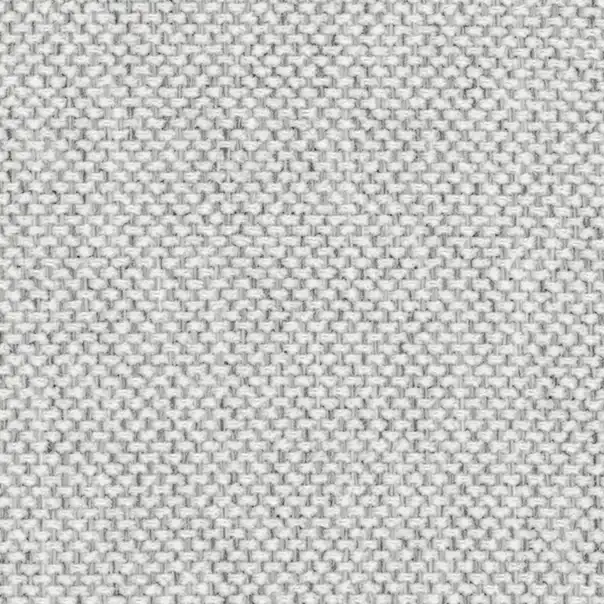

Style your way from top to bottom.

Mix or match various colors and materials available for your bassinet, seat, and canopy.

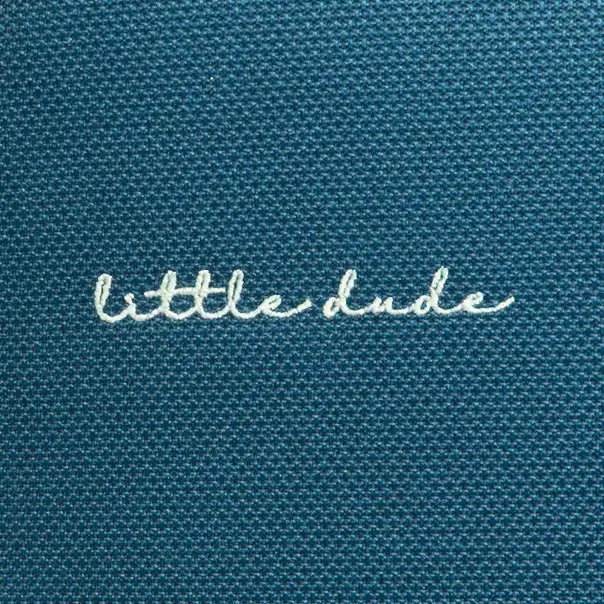

Unique to you. Down to the last stitch.

Make your stroller extra special with the addition of names, sayings, icons, and more personalized touches.

All custom gear orders are final sale. Due to the nature in which we design, build, and process your personalized order, we cannot accept cancellations, exchanges or returns.

Our dedicated Team Members will be happy to walk you through the process from start to finish at our Boston Hub Service Center. Click below to schedule an appointment!

The TAILORED Customization Studio will only be offered at our flagship Hub Service Center in Boston.

Only those who purchase a new Vista V2 or Cruz V2 stroller at our flagship Hub Service Center in Boston can customize and embroider their strollers. You may, however, purchase new fabrics!

We will not be embroidering any UPPAbaby accessories, canopies, or other home items if they are brought into the Hub. Embroidery is strictly for TAILORED customized Vista V2 and Cruz V2 strollers only.

We only offer our current stroller/canopy and bassinet fabric fashions, frame, and leather options. We do not have the ability to customize a new fashion that is not part of our current product line.

Each TAILORED stroller must be picked up in person at the Boston Hub. We are unable to ship any orders.