一車一世界。®

Vista 的人性化設計可搭配多種配置,讓同時推著第二個或是第三個孩子時變得輕而易舉,像是獨自在散步一樣。

雙向幼兒座椅

您的孩子能夠向前、向後、完全直立、斜靠,以及在這兩者之間的任何位置推行。

單手操控,座椅可多段式傾斜

多段式傾斜能讓您的孩子舒適地平躺著小睡片刻,或是豎直坐起來欣賞風景,為您那充滿好奇心的寶貝提供了所有的便利性。

可伸展的 UPF 50+ 頂篷

配置於幼兒座椅上的拉鍊式延伸頂篷,讓全家人一起享受美好陽光。

可伸縮皮革手把

可調整手把可調整高低,適合各種身高的父母,包覆頂級全粒面皮革,推動嬰兒車時更好抓握。

高度可調整頂篷

頂篷能輕鬆滑動調整高度,以配合不斷成長的孩子。

收合時仍可直立放置

Vista的單一步驟收合設計,操作起來輕鬆又方便。

超大容量 收取方便的置物籃

大開口意味著您能更輕鬆地拿取媽媽包、玩具及攜帶您所需的任何東西。

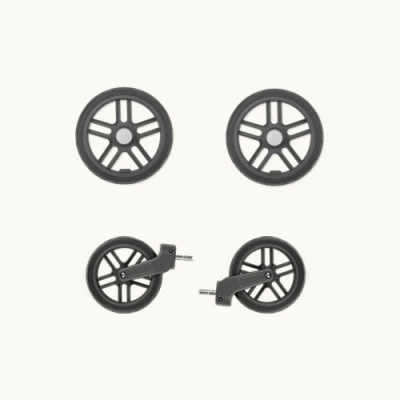

四輪懸吊減震

不論是在下坡彎道還是顛簸的人行道,獨立的減震設計確保您的孩子擁有平穩舒適的乘坐體驗。

推動時尚潮流

配件和擴充

新生兒提籃汽座轉接配件

Vista 可使用汽座轉接配件搭配 Maxi-Cosi、Cybex、Nuna、BeSafe 和 Chicco 提籃汽座使用。

豐富配件,巧思盡現

無論您走到哪裡,多元的配件系列,讓您持續推著嬰兒車,愉悅地前進。

內容物包含

幼兒座椅 + 防撞桿

框架

車輪

嬰兒車蚊帳

嬰兒車擋雨罩

規格

搭配新生兒座墊即可適用於新生兒(另行加購)

嬰兒車,6 個月以上、最高15公斤適用

實重 (包含頂篷、車輪和置物籃)

框架 + 座椅:12.4 公斤

框架:9.1 公斤

座椅:3.3 公斤

展開:91.4 長 X 65.3 寬 X 100.3 高

安裝座椅時收合:44 長 x 65.3 寬 x 84.5 高

無安裝座椅時收合:33 長 x 65.3 寬 x 81.3 高

主要特色

- 加裝摺疊座椅和推車輔助踏板,可同時移動三個小孩

- 舒適全尺寸雙向幼兒座椅

- 五點式可調節安全帶

- 拉鍊式伸展頂篷,搭配 UPF 50+ 防曬和網布透氣探視窗

- 透氣探視窗

- 單手操作,多段式傾斜

- 可伸縮皮革手把

- 超大容量,取放方便的置物籃,承重最高 13.6 公斤

- 四輪懸吊避震

- 前輪上鎖燈號設計方便辨識

- 加裝轉接配件可搭配新生兒汽車座椅提籃

- 100% 全粒面皮革

- 一個動作收合,收合時仍可直立放置