Kompaktowy bez kompromisów.®

Prosta konstrukcja wózka Cruz da Ci więcej możliwości, minimalizując wszelkie ograniczenia. Możesz swobodnie spacerować po wyboistych ulicach, manewrować w zatłoczonych centrach handlowych lub zapakować do koszyka wszelkie potrzebne rzeczy.

Odwracane siedzisko

Dziecko może podróżować przodem do kierunku jazdy, tyłem do kierunku jazdy, w pozycji całkowicie pionowej, leżącej lub przy dowolnym ustawieniu pochylenia.

Odchylanie jedną ręką

Wielopozycyjna leżanka pozwala Twojemu dziecku leżeć wygodnie podczas snu lub siedzieć i oglądać świat dookoła, oferując elastyczność, której potrzebuje Twój ruchliwy maluch.

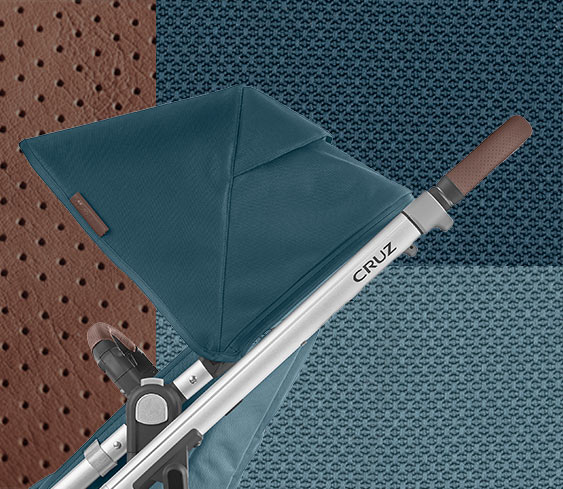

Rozkładana budka z filtrem UPF 50+

Budka wykonana z rozpinanej tkaniny, dzięki czemu można ją rozłożyć i poszerzyć osłonę przed słońcem. Wstawki z siateczki zwiększają przepływ powietrza i pozwalają zaglądać do środka.

Teleskopowa skórzana rączka

Naszą regulowaną rączkę można wydłużyć i dostosować do wzrostu rodzica. Pokryta jest skórą licową najwyższej jakości, która zapewnia mocny chwyt podczas pchania wózka.

Regulacja wysokości budki

Budkę można łatwo przesuwać, dostosowując ją do potrzeb rosnącego dziecka

Bardzo duży i łatwo dostępny kosz

Duży otwór pozwala łatwo sięgnąć po torbę na pieluchy, zabawki i wszystkie inne rzeczy, które schowasz w nim po drodze.

Amortyzacja na wszystkich kołach, opatentowany system dwustopniowy

Autonomiczne amortyzatory zapewniają dziecku komfort jazdy nawet po nierównym terenie.

Po złożeniu pewnie stoi

Funkcja składania jednym ruchem sprawia, że korzystanie z wózka Cruz jest wygodne i intuicyjne. Wózek nie przewraca się po złożeniu; można go złożyć zarówno z siedziskiem, jak i bez niego.

Bezpłatne próbki tkanin

Nie masz pewności, która tkanina będzie dla Ciebie odpowiednia? Skorzystaj z naszego programu „Wybierz swój styl” i wybierz do 4 bezpłatnych próbek tkanin wózków, które zostaną do Ciebie wysłane.

Przydatny od chwili narodzin

Gondola

Model Cruz można przekształcić w wózek dla noworodka. Gdy przyjdzie czas na drzemkę w parku lub konieczność przenocowania poza domem, gondola zapewnia dziecku możliwość bezpiecznego leżenia w pozycji płaskiej na zdrowym, wygodnym materacu.

Pasuje do fotelika samochodowego dla niemowląt

Dzięki wygodnym adapterom fotelik samochodowy dla niemowląt Mesa i-Size w połączeniu z wózkiem Cruz tworzą najlepszy pod kątem mobilności i bezpieczeństwa system podróżowania. Nie musisz tracić funkcjonalności, by zyskać wygodę.

Model Cruz wraz z adapterem pasuje do wybranych fotelików samochodowych dla niemowląt Maxi-Cosi®, Nuna®, Cybex i BeSafe®.

W zestawie

Siedzisko Toddler Seat + pałąk zabezpieczający

Rama + koła

Moskitiera siedziska

Osłona przeciwdeszczowa siedziska

Specyfikacje

Odpowiednie dla dzieci od 6 miesiąca życia do 22 kg

Rzeczywista waga (uwzględnia gondolę, koła, kosz)

Rama + siedzisko: 11,6 kg

Rama: 8,6 kg

Siedzisko: 3 kg

Wymiary po rozłożeniu: 95,3 cm (dł.) x 57,8 cm (szer.) x 101,6 cm (wys.)

Wymiary po złożeniu, z zamocowanym siedziskiem: 41,9 cm (dł.) x 57,8 cm (szer.) x 83,8 cm (wys.)

Wymiary po złożeniu, bez siedziska: 30,5 cm (dł.) x 57,8 cm (szer.) x 76,2 cm (wys.)

Najważniejsze funkcje

- Produkt odpowiedni dla noworodków, kiedy jest używany z gondolą akcesoriami

- Pełnowymiarowe, odwracane siedzisko

- Pięciopunktowa uprząż z łatwą regulacją

- Rozkładana budka na suwak z osłoną przeciwsłoneczną z filtrem UPF 50+ i wstawkami z siateczki

- Otwierane okienko wentylacyjne peekaboo

- Obsługa ustawień odchylenia jedną ręką

- Regulowana rączka

- Bardzo duży, łatwo dostępny kosz o ładowności do 13,6 kg

- Amortyzacja na wszystkich kołach

- Blokady przednich kół ze wskaźnikami wizualnymi

- Fotelik samochodowy dla niemowląt Mesa i-Size mocuje się bezpośrednio na wózku bez adapterów

- Detale wózka wykonane ze 100% skóry licowej

- Składanie jednym ruchem, po złożeniu można go postawić